Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

Mortgage rates have been the monster under the bed for a while. Every time they tick up, people flinch and say, “Maybe I’ll wait.” But here’s the twist. Waiting for that perfect 5-point-something rate could end up haunting your wallet later.

The “Magic Number” and What Experts Are Saying

According to the National Association of Realtors (NAR):

“. . . a 30-year fixed rate mortgage of 6% would make the median-priced home affordable for about 5.5 million more households—including 1.6 million renters. If rates were to hit that magic number, it’s likely that about 10%—or 550,000—of those additional households would buy a home over the next 12 or 18 months.”

When the market hits that mortgage rate sweet spot, as expert forecasters are starting to say is more likely in 2026, the psychological shift to lower rates will kick in for more of today’s hopeful buyers. That will unleash some pent-up demand that’s been waiting on the sidelines, and the increase in activity will cause prices to rise.

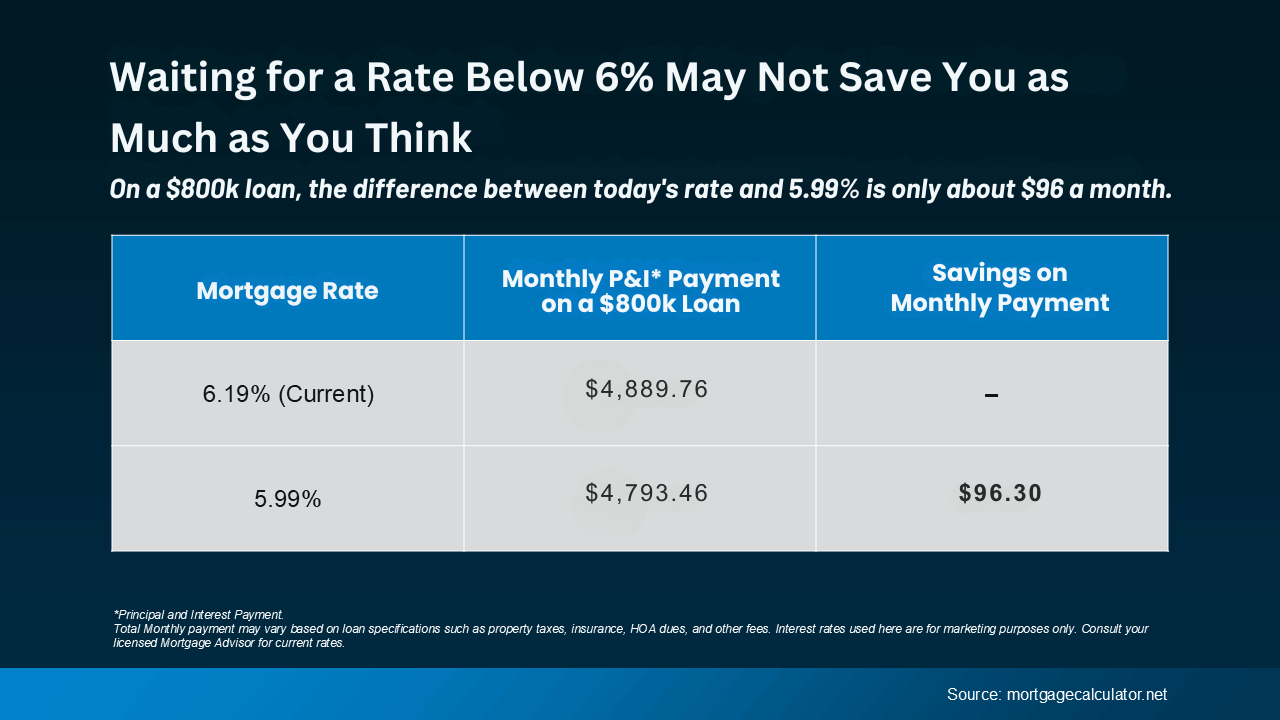

And while a 5.99% rate might sound like a big win, if you’re waiting for that number to make your move, it might not actually save you as much as you think. Here’s how the math looks when you run the numbers (see chart below):

The Real Cost of Waiting for 5.99%

On a $800,000 mortgage, the difference between today’s rate (around 6.2%) and 5.99% is roughly $96 a month. That’s less than many people spend on weekly coffee runs or occasional DoorDash orders. And as prices tick up with more buyers in the market, that could quickly negate any of your potential savings.

So, if you’re waiting for 5.99%, that difference might not be worth missing out on today’s opportunities, like having more homes to choose from, better negotiation leverage with today’s sellers, and fewer buyers out there looking for the same houses.

Because the reality is, those benefits start to slip away when more buyers begin to make their moves – and a rate under 6% is exactly they’re waiting for.

Why Acting Now Makes Sense

Jessica Lautz, Deputy Chief Economist and VP of Research at NAR, says:

“Over the last 5 weeks, mortgage rates have averaged 6.31%. This has provided savvy buyers a sweet spot to reexamine the home search process with more inventory, widening their choices.”

And like Matt Vernon, Head of Retail Lending at Bank of America, notes:

“Rather than waiting it out for a rate that they like better, hopeful homebuyers should assess their personal financial situation—if the house is right for them, and the upfront and monthly payments are affordable, it could be the right chance to make a move.”

Bottom Line

If today’s mortgage rates make you hesitate, remember — waiting doesn’t always pay off. Once rates dip below 6%, buyer competition will intensify and home prices across North San Diego County are likely to climb.

So, don’t fear today’s mortgage rates. This might be your best opportunity to find the right home before the market heats up again.

Ready to explore what’s available in your area?

🔍 Start Your Home Search — browse the latest listings in San Diego, Vista, Escondido, Fallbrook, and Oceanside.

📊 View a Market Snapshot — see how local home values and mortgage trends are moving right now.

📞 Contact Me — let’s discuss your goals and create a smart buying or selling strategy tailored to you.

Categories

- All Blogs (73)

- Buyer & Seller Resources (7)

- First-Time Buyers (3)

- Home Buying Tips (18)

- Home Improvement (1)

- Home Selling Tips (16)

- Homebuyer Tips (9)

- Homeowner Tips (6)

- Housing Market Insights (15)

- Housing Market Trends (15)

- Market Updates (5)

- Mortgage Education (4)

- Mortgage Insights (4)

- New Construction (2)

- Pricing Strategy (1)

- Real Estate Advice for Buyers (6)

- Real Estate Advice for Sellers (10)

- Real Estate Insights (12)

- Real Estate Market Updates (11)

- Renting vs. Owning (1)

- Seller Resources (4)

- Sellers (2)

- VA Home Loans (1)

Recent Posts