The VA Home Loan Advantage: What Every Veteran Should Know Right Now

If you’ve served in the military (or if your spouse has), you have access to one of the most powerful homebuying tools out there. The chance to buy a home without having a down payment.

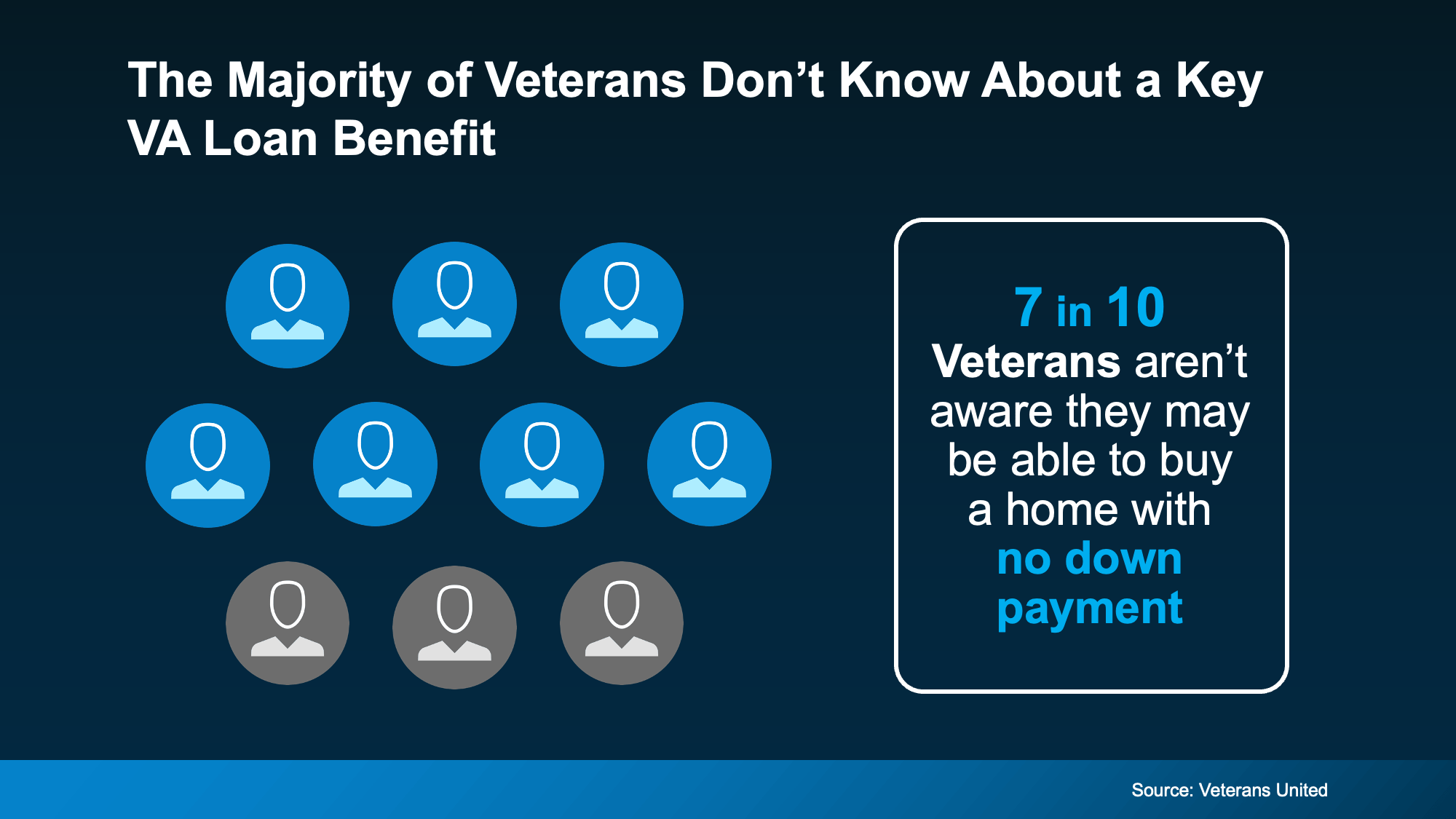

Unfortunately, 70% of Veterans (that's 7 out of every 10) don’t know about this benefit, according to Veterans United.

And that’s a big missed opportunity for those who’ve earned this benefit through service. So, let’s break down what you really need to know about Veterans Affairs (VA) home loans right now.

Why VA Home Loans Can Be a Great Option

For nearly 80 years, VA loans have made homeownership possible for millions of Veterans and active-duty service members. Here are just a few of the top perks according to the Department of Veteran Affairs:

- Options for $0 Down Payment: Many Veterans can buy a home without spending years saving up.

- Fewer Upfront Costs: The VA limits which types of closing costs Veterans have to pay, helping you keep more cash on hand when you’re finalizing your purchase.

- No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI, lowering your monthly costs.

These features make VA loans a great way for service members (or their family) to build stability, save money, and start creating long-term wealth through homeownership.

Can You Still Get a VA Loan with the Government Shutdown?

But lately, there’s been some confusion about whether VA loans are still available due to the government shutdown. And that uncertainty has kept some Veterans from taking the next step.

While there may be processing delays, Veterans United explains you can still get a loan:

“There’s been a lot of confusion and uncertainty about how a government shutdown will affect VA home loans . . . The good news is that the shutdown has minimal impacts on VA lending. Lenders are still able to order appraisals, obtain a borrower’s Certificate of Eligibility, submit the VA Funding Fee and more. In short, Veterans are still able to use their home loan benefit to buy a home or refinance an existing mortgage.”

So, despite the headlines, you can still use your VA home loan benefits today. The process is ready when you are. It just may take more time to go through.

Why the Right Agent and Lender Matter

Just remember, using your VA home loan is easier (and smoother) when you have the right team behind you. As VA News puts it:

“Choosing a military-friendly broker or agent who understands the VA home loan application process can make all the difference in the homebuying experience. Finding the right agency or brokerage is just as important as locking in a good VA mortgage lender. Communication is key to getting to the loan closing table.”

A knowledgeable agent and an experienced lender can help you navigate every step, all the way from qualifying to closing. With their help, you can make sure you’re getting the most out of your benefits.

Bottom Line

If you’re a Veteran, a VA home loan is one of the most valuable benefits you’ve earned through your service. It offers options for no down payment, limited closing costs, and more — helping you build stability and long-term wealth through homeownership right here in North San Diego County.

Whether you’re searching for Luxury Homes, exploring Homes for Sale in Bonsall, or looking across North San Diego County Real Estate, the opportunity to own your home is closer than you think.

Talk to a lender so you can take full advantage of the benefits you’ve earned and start your path toward homeownership today.

Ready to take the next step?

🔍 Start Your Home Search – Explore current listings and available Homes for Sale across North San Diego County.

📊 Get Your Market Snapshot – Stay updated on the latest real estate trends and local home evaluations.

🧮 Use the Mortgage Calculator – Estimate your monthly payments and plan your budget with confidence.

💰 Find Out Your Home Value – Request a free home evaluation from a local Realtor specializing in Luxury Homes and North San Diego County Real Estate.

Categories

- All Blogs (73)

- Buyer & Seller Resources (7)

- First-Time Buyers (3)

- Home Buying Tips (18)

- Home Improvement (1)

- Home Selling Tips (16)

- Homebuyer Tips (9)

- Homeowner Tips (6)

- Housing Market Insights (15)

- Housing Market Trends (15)

- Market Updates (5)

- Mortgage Education (4)

- Mortgage Insights (4)

- New Construction (2)

- Pricing Strategy (1)

- Real Estate Advice for Buyers (6)

- Real Estate Advice for Sellers (10)

- Real Estate Insights (12)

- Real Estate Market Updates (11)

- Renting vs. Owning (1)

- Seller Resources (4)

- Sellers (2)

- VA Home Loans (1)

Recent Posts