Would You Let $160 a Month Hold You Back from Buying a Home?

A lot of buyers are stuck in “wait and see” mode right now. They’re watching rates hover a little above 6% and thinking, I’ll buy once they hit the 5s. Because who doesn’t want a better rate?

But here’s the thing: that 5.99% number might not save you as much as you think.

Affordability is still a challenge. There’s no question about that. But the market has given savvy buyers a head start. Mortgage rates have already come down over the past few months. And the drop we’ve seen saves you more than you’d think.

How Much You’ve Already Saved, Without Realizing It

Let’s put some real numbers to it. Rates peaked for the year in May when they moved above 7%. But since then, they’ve been slowly declining. Now they’re sitting in the low 6s. And while that may not sound like a big deal, even a small rate drop can translate into real savings for today’s buyers.

If you’re buying a home now, you’re likely paying noticeably less each month than you would have earlier this spring when rates were at their highest. That shift makes a meaningful difference for buyers who paused their plans because they thought homeownership was out of reach.

And while it may be tempting to wait even longer to see bigger savings, that’s a gamble that could cost you. Here’s why.

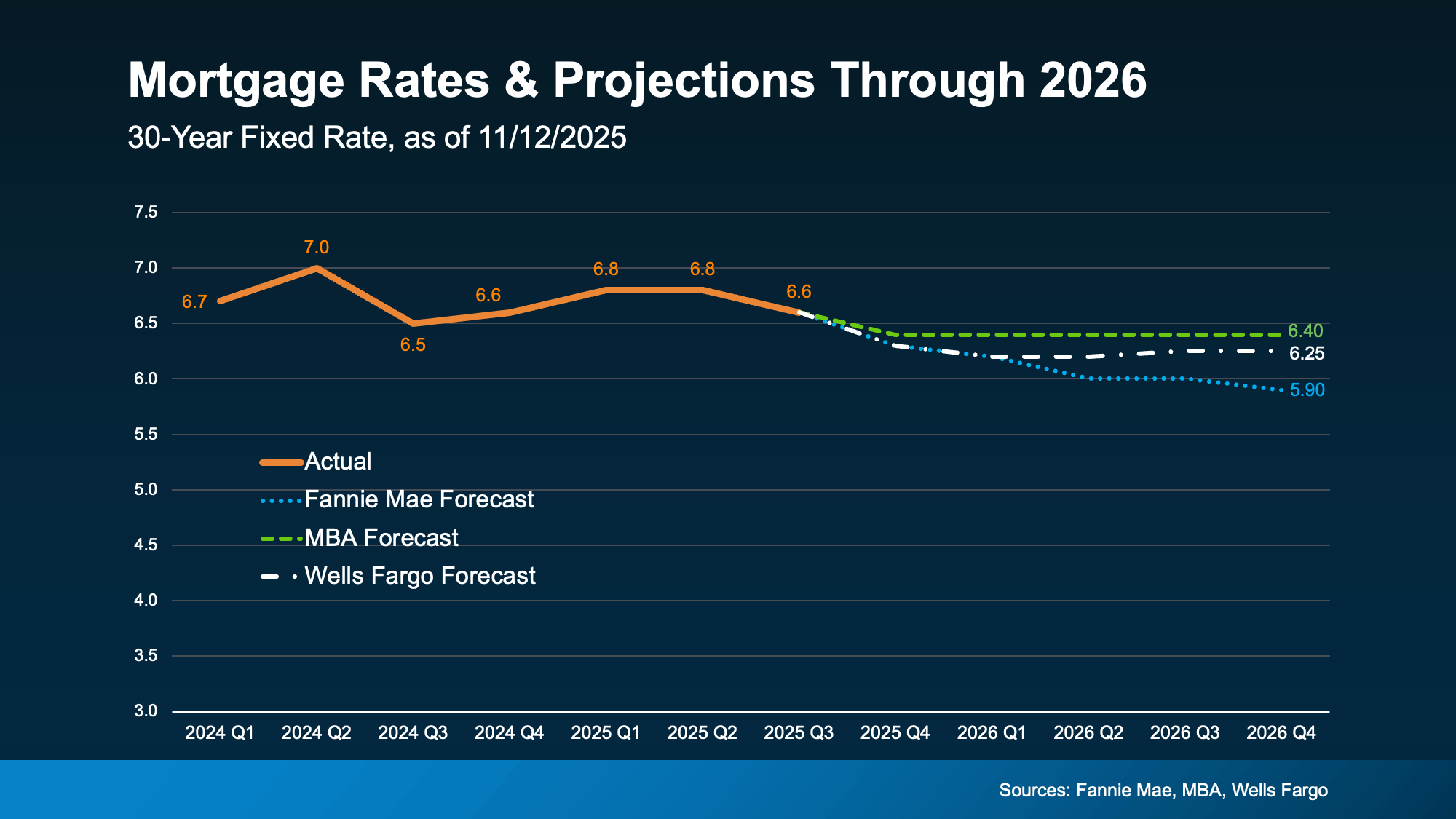

Where Experts Say Rates Are Headed

For starters, most experts say mortgage rates are likely to stay pretty much where we are today throughout 2026. So, there’s no guarantee we’ll see a rate much lower than what we have now. Only one expert forecaster is saying rates could fall into the upper 5s next year (see graph below):

And even if rates do dip below 6%, the extra savings you’re holding out for won’t move the needle as much as you might expect.

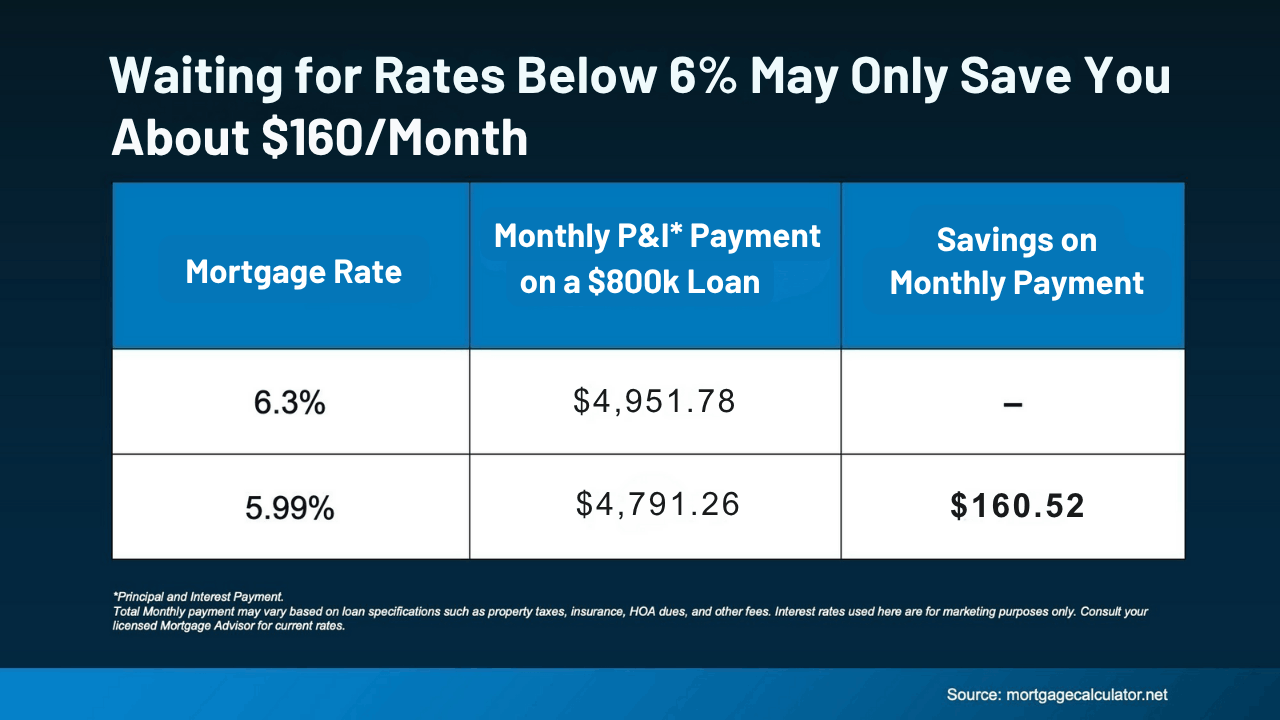

The Real Math Behind a 5.99% Rate

Let’s break it down. If rates come down to 5.99% from where they’ve been lately, that’s a difference of only about $160 a month on an $800,000 loan – give or take a bit based on your price point and the rate your lender quotes you (see chart below).

$160. That’s it. And for the typical family, that’s about one dinner out (or one dinner in if you have it delivered). It’s helpful, but it’s not a game-changer for most buyers.

So, the question to ask yourself is this:

Is an extra $160 savings really worth the wait?

Because while you’re holding out for that small dip, the bigger opportunity might be slipping away.

When Rates Fall, Competition Follows

Right now, you have more homes to choose from, sellers who are ready to negotiate to get a deal done, and fewer buyers to compete with. But once rates fall below 6%, buyer mindsets will shift and all of that will change.

The National Association of Realtors (NAR) reports that if rates hit 6%, about 5.5 million more households will be able to afford the median-priced home. Even if only a small fraction of them decide to buy, that could mean hundreds of thousands of buyers getting back into the market.

That creates more competition for you, which would push home prices even higher – maybe high enough to cancel out the extra savings you waited for.

So, if you’re waiting for rates below 6%, just keep in mind... that extra $160 may not be worth it in the grand scheme of things.

Bottom Line

You don’t have to wait for 5.99%. You have the opportunity to move (and save) right now. So, ask yourself: Would you let $160 a month hold you back from buying a home?

If you find a home you love and the math makes sense, getting ahead may be the best strategy. Let’s run your numbers so you can see exactly what you're working with in the North County San Diego market — from San Marcos and Escondido to Vista, Carlsbad, Oceanside, and surrounding communities.

Take Your Next Step:

- Home Search – Explore the latest homes for sale in North County San Diego.

- Home Value – See what your home could sell for in today’s market.

- Market Snapshot – Get real-time data on your neighborhood’s trends.

- Mortgage Calculator – Estimate your monthly payment at today’s rates.

- Contact Us – Have questions? Ready to tour? Reach out anytime.

Categories

- All Blogs (73)

- Buyer & Seller Resources (7)

- First-Time Buyers (3)

- Home Buying Tips (18)

- Home Improvement (1)

- Home Selling Tips (16)

- Homebuyer Tips (9)

- Homeowner Tips (6)

- Housing Market Insights (15)

- Housing Market Trends (15)

- Market Updates (5)

- Mortgage Education (4)

- Mortgage Insights (4)

- New Construction (2)

- Pricing Strategy (1)

- Real Estate Advice for Buyers (6)

- Real Estate Advice for Sellers (10)

- Real Estate Insights (12)

- Real Estate Market Updates (11)

- Renting vs. Owning (1)

- Seller Resources (4)

- Sellers (2)

- VA Home Loans (1)

Recent Posts